"How might we design a service that makes young adults (ages 18-35) feel comfortable talking about health insurance and feel empowered about picking their plans?"

[01] PROJECT OVERVIEW

Timeline: Fieldwork & Service Design Courses, Fall 2023 Semester

Challenge: Come up with a design that will aid people navigate how to pick an insurance plan or provider.

Solution: An insurance cafe that utilizes the concept of blended spaces and provides several engagement methods that cater to different personalities and knowledge levels in order to educate people about insurance topics, and thus reduce the rate of underinsurance.

Team: Allex Llenos, Jasmine Chen, Karl Sheeran, Prathi Selvapathi

[02] INTRODUCTION

Underinsurance is most commonly defined as a state in which people with insurance coverage are still exposed to financial risk. Insufficient insurance coverage leaves the policyholder responsible for a large percentage of expense and may lead to financial hardship.

Statistics show that 66.5% of all bankruptcies are tied to medical issues, and that about 530,000 families turn to bankruptcy each year due to medical issues and bills.

The project centers around the general understanding that picking an insurance plan is not a comprehensive process, and is a source of frustration for many citizens in the U.S. All of our team members had some sort of experience with the insurance system, whether it was from the medical provider or patient end.

Target Demographic: 18-35 year-olds

Objective: Determine the relationship between major life changes and picking insurance plans, and understand people's thought processes and feelings when picking insurance for the first time.

Assumptions: Picking insurance is difficult, and we would like to see how to shift users' attitudes by identifying which point in the process would benefit from intervention.

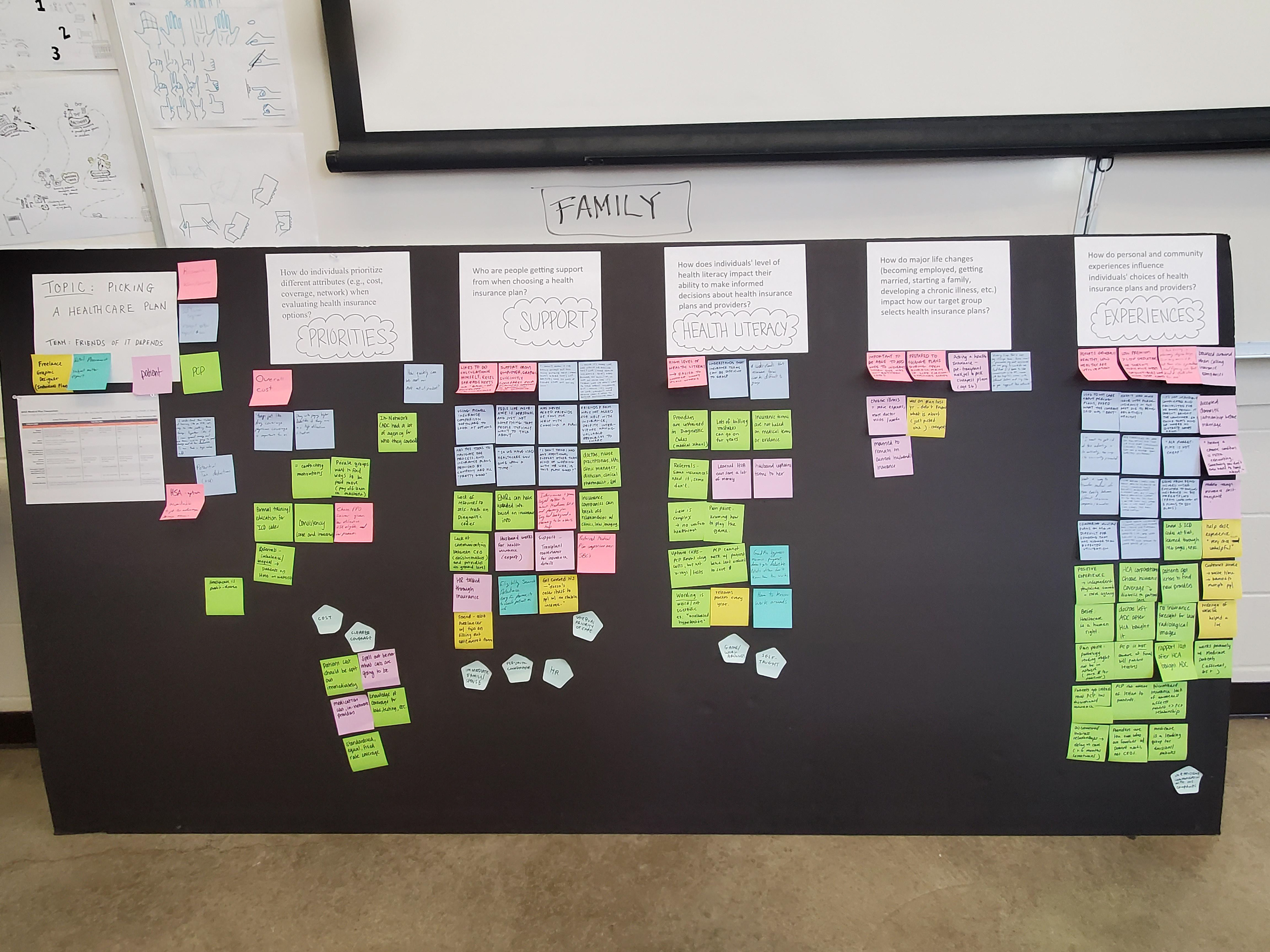

[03] DESIGN RESEARCH

Research Goal: Gain a comprehensive understanding of how individuals in the 18-35 age range choose health insurance plans in order to reduce the rate of underinsured individuals in the user group.

Intercepts:

Card sort exercise conducted on UT Speedway near Gregory Gymnasium.

We created an interactive football field in hopes of attracting students to talk about insurance while minimizing intimidation around the concept. We wanted to gauge health literacy and see if there were any trends when it comes to prioritizing different insurance components.

First Phase: Participants were asked to sort the cards between insurance terms that they knew (or felt they knew) vs. insurance terms that they did not know.

Second Phase: After looking at the card definitions, participants were asked to sort the cards on the "playing field" by priority (1 = lowest priority, 5 = highest priority). At this point, participants were allowed to double check term definitions to make sure they understood.

In-Depth Interviews:

We spoke to six people total. All of our participants were health insurance users, but half of them could be coined as 'subject matter experts' as we spoke to a pharmacist, a physician, and a software engineer that worked on a tool to help compare insurance plans.

Our team conducted these interviews in order to gain different perspectives of people's interactions and experiences with the insurance system. What was it like to deal with insurance as a patient vs. as a provider? Generally healthy vs. chronically ill? Receiving health insurance through employment or using the individual health exchange market? Through our interviews, we were able to identify various pain points.

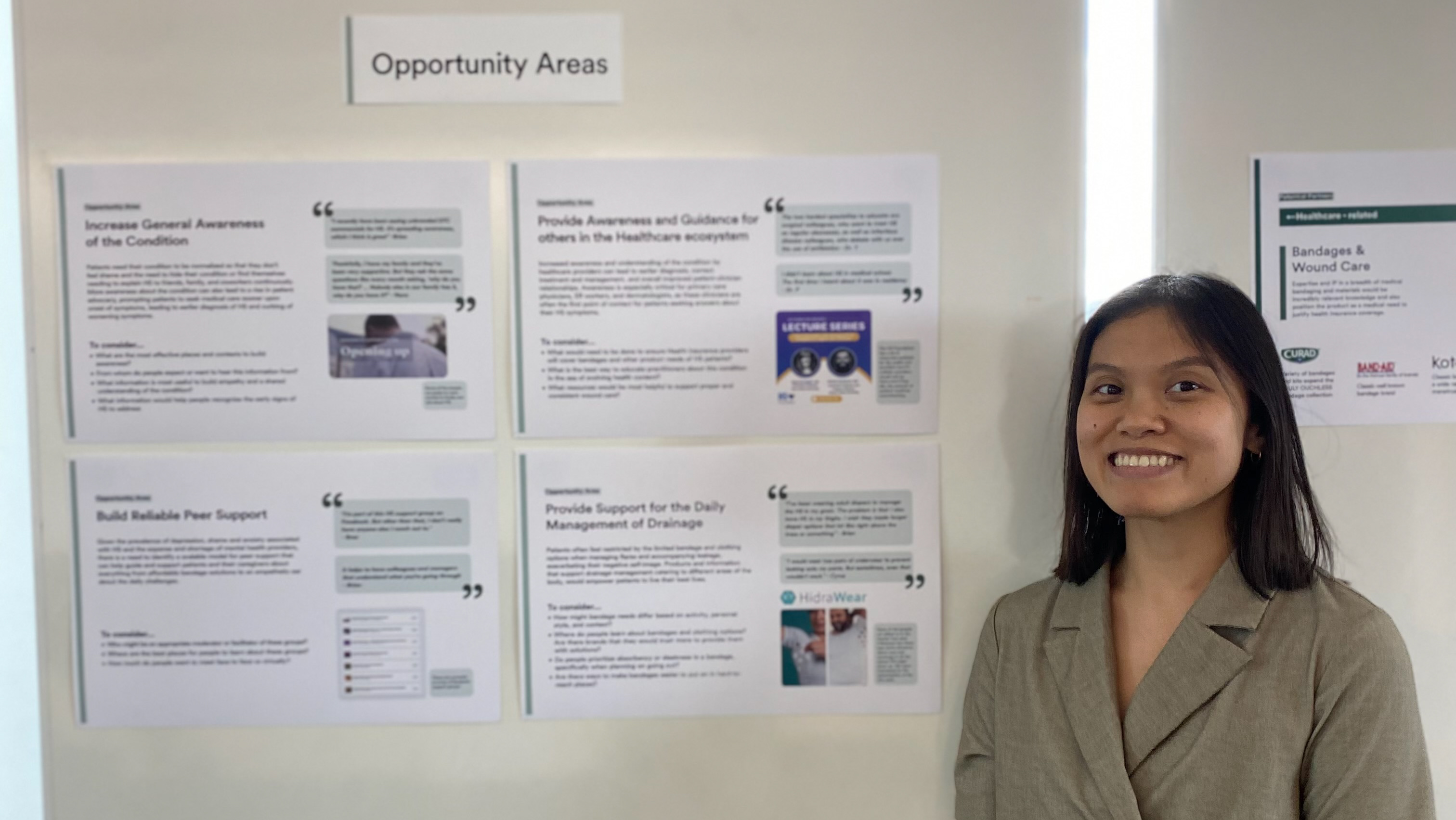

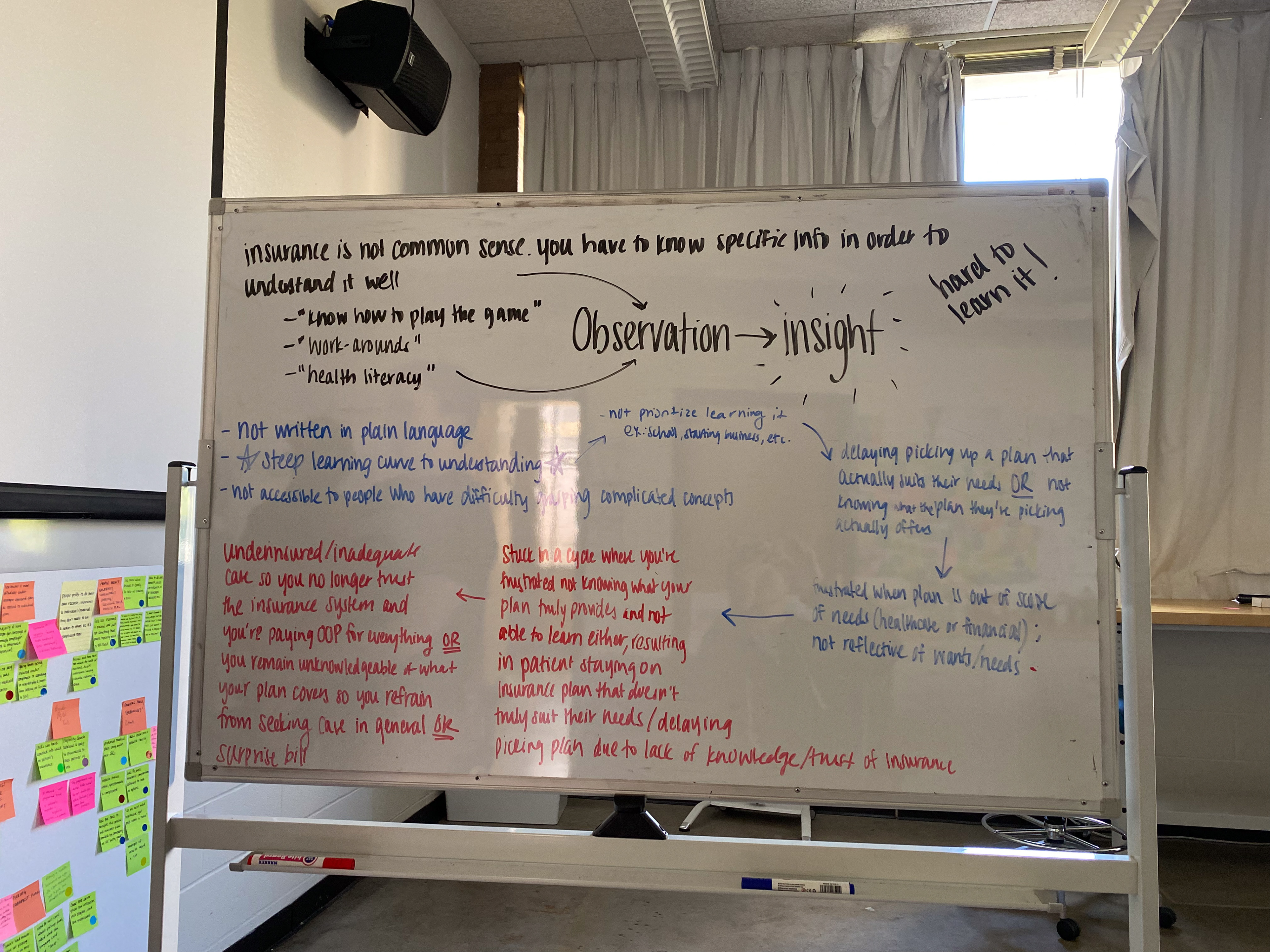

[04] SYNTHESIS & INSIGHTS

Following the interviews, our team worked to find overlapping themes from our users' experiences with insurance. We found that there was a need for continued learning in order to understand coverage, and sometimes that would still not be enough, even leaving some people more confused than they initially started. What we found most interesting was the fact that people actually make life decisions based on their coverage, rather than the other way around like we initially hypothesized.

Insights:

1. Choosing insurance is a guessing game where there is no winner.

2. People often make life decisions based on insurance coverage.

3. People feel a loss of autonomy when it comes to picking their health insurance.

4. People feel more comfortable making financial decisions around known costs.

[05] DESIGN SOLUTION

"Many life changes happen to the demographic of 18-35 year-olds. We can help young adults be more prepared for picking insurance plans when they are experiencing a period of major life changes."

Our group took a deep dive into the health insurance ecosystem map to find where our service might have the largest impact. We thought it would be most feasible to tackle the topic from the individual and community levels since:

1. It is difficult to transform deeply rooted systems, especially in the course of a couple of months/years.

2. A person's health journey is unique, and the solution should cater to different circumstances and knowledge levels.

3. Working at a community level would still be able to reach a breadth of users, while allowing for constructive feedback that could improve the model and strengthen its impact through co-creation.

Ultimately, we decided on three forms of education to be integrated into the cafe space: seminars, Game of LIFE: Health Edition, and 1:1 private consultations.

Seminars: At base level, these were meant to provide patrons with knowledge about basic insurance terms. Seminars occur all day at the cafe, rotating topics and difficulty levels (beginner - advanced) to keep users engaged and continuously learning.

Board Game: At the beginning of the game, players would choose their career and a health insurance plan. They would then play the game and experience some sort of medical issue. This was a way for cafe goers to practice forecasting, without the pressure of incurring medical debt in real life.

Consultations: These 1:1 sessions were implemented for people to talk about more personal concerns or if they did not feel comfortable talking about insurance-related topics in larger settings like the seminars or game tables. Our insurance experts would not be affiliated with any large insurance company, but just be a person who was very knowledgeable about the insurance system.

[06] PROTOTYPING

Our goal was to have our users experience the three different services the cafe had to offer, and to let us know if they had any preferences for any of the services, and any feedback for improvement. On a typical day, cafe goers would be able to "choose their own adventure," meaning that they did not have to necessarily utilize all services in one day, and could potentially only use one service and return on a separate occasion to use another.

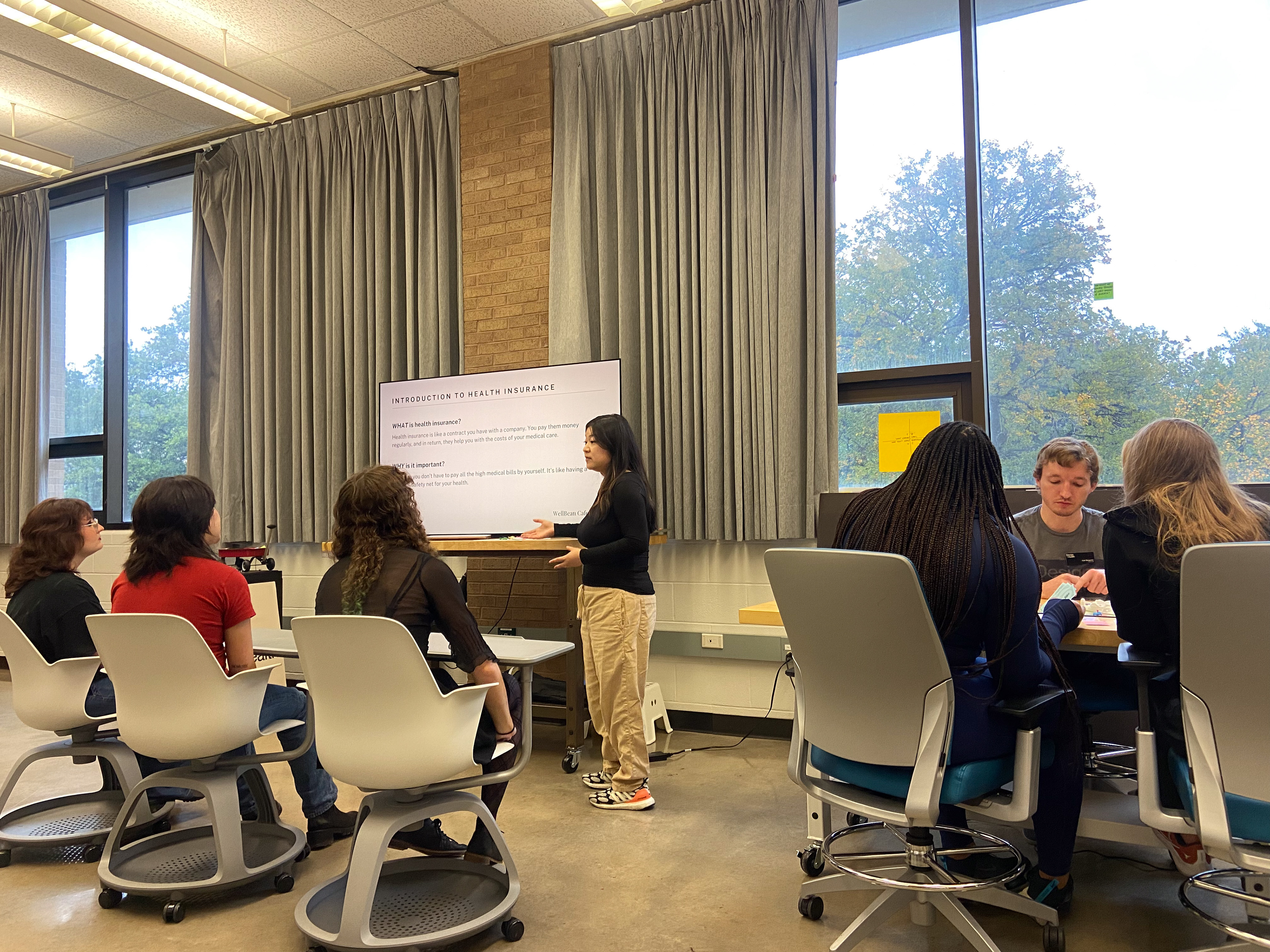

There were four roles that we took upon during our prototyping session: greeter (myself), seminar facilitator (Jasmine), game master (Karl), and insurance expert (Prathi).

Our users had differences in their preferences for the services, but all of them noted that the services had increasing level of difficulty, with seminars being 'beginner,' the game being 'intermediate,' and the 1:1 consultations being 'advanced.'

[07] KEY TAKEAWAYS

1. It was effective to use diverse methods (seminars, game, 1:1 consultations) to cater to different personalities and knowledge levels when educating about insurance.

2. Users appreciate a balance between having guidance from service “employees” and having the freedom to shape their own experience in the space.

“Fairy godparent vibes in a medical context, very nice”

3. Users may feel intimidation to engage in 1:1 consultations due to lack of insurance knowledge, fearing they might seem misinformed. They may feel uncertainty about how to initiate and sustain a conversation about insurance, discouraging participation.

4. Seminars were favored for their casual atmosphere, approachability, informative content, and option for anonymity. Users saw seminars as a welcoming entry point to building knowledge before engaging in 1:1 consultations.

5. Gameplay was enjoyable in a group setting vs. single-player, and helped users feel better about forecasting medical events. However, using the Game of LIFE as basis meant that prices did not always accurately represent real life scenarios, and there were questions about whether the game would always need to be facilitated by a game master, or if players could engage in the board game freely without guidance.

The Team: The Friends of "It Depends"